If you have decided to cancel your Citibank credit card, there are two possible options to choose from. There may be several reasons why you made this decision – lack of use, increased fees, or simply an unsatisfactory experience with the service. No matter the reason, it's important to know how to cancel to avoid unwanted fees and negative impact on your credit score and credit history.

The first option is to submit the cancellation by mail. To do this, you should send a written cancellation request to Citibank. The letter should include your full name, credit card number and the date you want the cancellation to take effect. It is also advisable to include a copy of your credit card agreement to ensure that the cancellation goes smoothly.

The second option is to request cancellation over the phone. Communicating directly with Citibank customer support will help you find a solution quickly and efficiently. Mention that you want to cancel your credit card and provide the customer support representative with your card number and cancellation date. You may be asked to confirm the cancellation in writing in order to receive approval.

Regardless of which option you choose, it's important that you stick to the specified date to avoid unwanted fees and hassles. Also remember to cut up or destroy your credit card to avoid possible fraud.

Overall, canceling your Citibank credit card is an important step in getting yourself financially organized and ensuring you don't have to pay any unwanted fees. Make sure you choose the right method for your situation and that you meet your cancellation requirements to ensure a stress-free ending.

The best 2 ways to cancel your Citibank credit card

If you have a Citibank credit card but are thinking about canceling it for some reason, there are two ways to do it.

1. By phone

The easiest way to cancel your Citibank credit card is by phone. Call the number on the back of your card and follow the instructions of the customer service representative. They will then likely ask you some questions to make sure you are the rightful owner of the card. Remember to have your credit card information ready when you call.

2. In writing

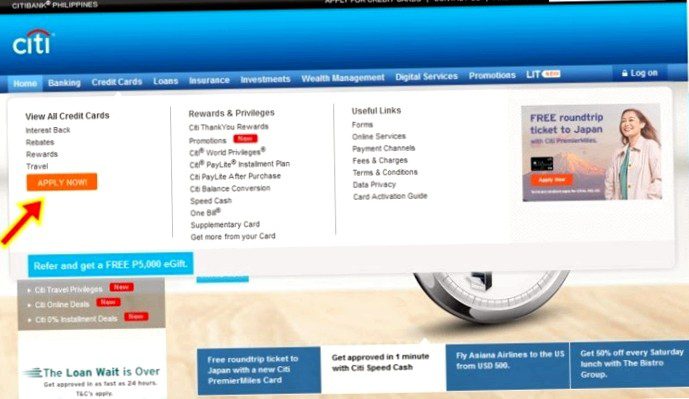

You can also cancel your Citibank credit card in writing. Simply download the cancellation form from the Citibank website, fill it out and mail it to the address on the form. Keep in mind that it may take some time for the letter to arrive and the cancellation to be processed.

Regardless of which method you choose, make sure you pay all outstanding bills and that no outstanding balances remain on your card. If you cancel your Citibank credit card with no outstanding bills, it will not affect your credit score.

- Bottom line: there are two ways to cancel your Citibank credit card: by phone or in writing. Make sure all outstanding balances are paid before you submit the notice of termination.

How to use the latest methods to close Citibank credit cards

If you have a Citibank credit card and are concerned that this may impact your credit score, you should know that there are certain factors that could contribute to lowering your score. For example, credit cards have their own limits, and using your card to the limit could result in higher credit utilization, which affects your score. In addition, your monthly credit card spending could also lead to a higher overall daily balance, which can also negatively impact your credit score.

If you now decide to close your card, you can choose between several options. The first method is to speak directly with Citibank customer service and make a request to close your card. The second method is to send an email to Citibank with your request to close your card.

If you choose the second method, make sure you have an email address to reply to in case Citibank needs additional information to close your card. In addition, keep in mind that closing your card can cause your credit score to drop in the short term, as this can be a sign to future lenders that you've had trouble processing your credit card.

- Method 1: Call Citibank customer service directly

- Method 2: Request to close your card via email

2 Ways to close a recent Citibank credit card

If you don't have enough funds to pay off your Citibank credit card debt, you should find strategies to pay it off before you close your card. Here are some options you can try before closing the card.

- 1. Installment plan: Citibank offers an option for installment payment plans. You can repay your debt in set installments without having to worry about exorbitant interest rates. If you choose this option, make sure you make the installment payments on time to maintain your credit score.

- 2. Credit card balance: If you have another credit card with lower interest rates, you can transfer the balance to your Citibank card and then pay back the amount you need to charge off. Most credit card companies offer a zero percent introductory rate on credit card balances.

There are, of course, other ways to reduce debt and close CitiBank credit cards, but these two options are good places to start. Make sure you read and understand all the terms and costs carefully before making a decision. If you can't implement any of these options, it may be best to close the card and pay off your debt in other ways.