The business model, in which customers receive goods immediately and can pay for them at a later date, has become increasingly popular in recent years. But what happens when interest rates rise?

Many online stores and retailers now offer this option to encourage customers to buy and increase sales. But while this model is often very attractive to customers, it poses some risk to merchants, especially in a rising interest rate environment.

In this article, we take a closer look at the “buy now, pay later” business model business model and analyze the impact of rising interest rates on this model. This will highlight the dangers and opportunities associated with this model, and the alternatives available to retailers.

To consider the issue in detail, the background to the “buy now, pay later” model is first explained. Building on this, we examine and discuss the potential consequences of rising interest rates for retailers. Finally, strategies are presented on how retailers can remain successful despite rising interest rates.

Introduction

With the advent of online shopping, new business models and payment methods have also emerged. One of the most popular is the “buy now, pay later” model concept, where customers can receive products first and pay later. This model has gained tremendous popularity in recent years, as it offers many benefits to both consumers and retailers.

However, rising interest rates are putting this business model to the test. Interest rates are rising due to changes in the economy and central bank policy, and this can have severe implications for the concept of “buy now, pay later”.

This analysis will look at the impact of rising interest rates on the “buy now, pay later” business model business model. The impact of rising interest rates on the model and alternative options for consumers and merchants are examined.

- 1. Effects of rising interest rates

- 2. Alternatives for consumers and retailers

- 3. Conclusion

Background

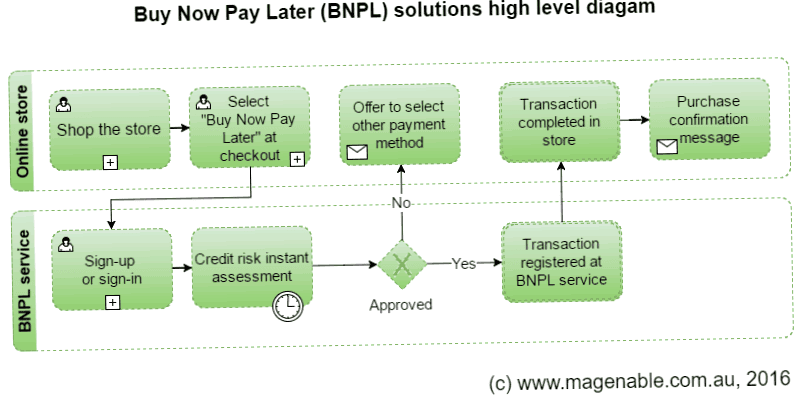

In recent years, the “buy now, pay later” business model has become more and more popular business model has become increasingly popular. Many companies offer their customers the option of buying products and paying at a later date. This model has the advantage for customers that they immediately receive the desired product without having to pay immediately.

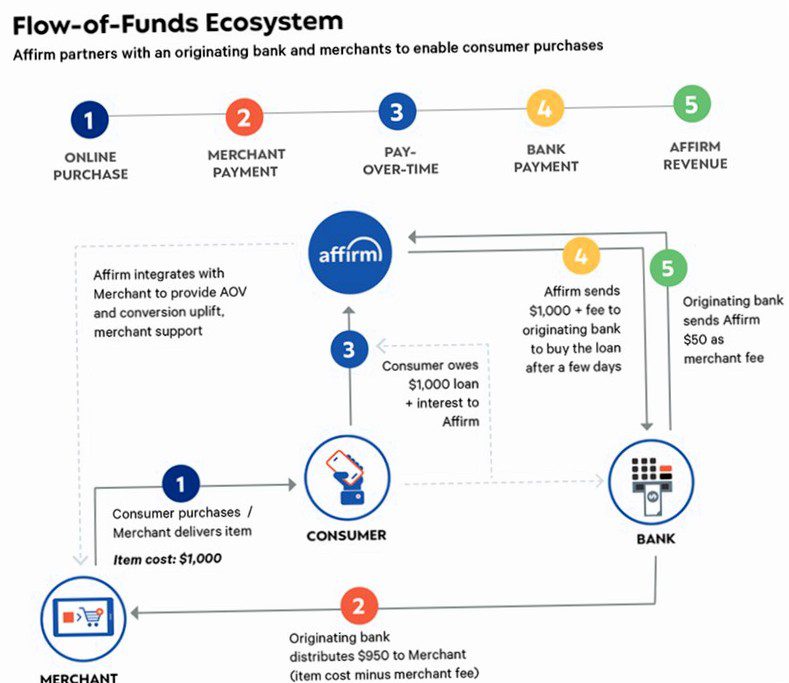

The business model is based on credit granted by the company to the customer. The loan is usually repaid at a later date, often in installments. The customer pays interest and fees.

However, as interest rates rise, this business model will be put to the test. When interest rates rise, so does the cost of credit. This may lead to a higher burden for customers. Businesses will therefore need to adjust their prices or rethink the model.

- The “buy now, pay later offer tends to become more expensive for customers in the context of rising interest rates.

- Businesses need to adjust their prices to remain competitive.

- The “buy now, pay later” business model will only be successful in the long term if interest rates remain low.

The challenges of the “buy now, pay later” model business model

The “buy now, pay later business model has gained popularity in recent years. It offers consumers the opportunity to purchase goods and services without having to pay for them immediately. For companies, this means higher customer loyalty and an increase in sales figures.

However, rising interest rates could have an impact on this business model. As business lending becomes more expensive, the cost to consumers could also increase. Companies might need to offer higher interest rates to cover their costs. This in turn would lead to a reduction in customer loyalty and could potentially lead to a decline in sales.

Further, rising interest rates could also mean that consumers cannot solve their payment problems as easily as before. When interest rates are high, consumers may have to make higher installment payments to repay their debts. This can lead to higher default rates and thus a higher financial risk for companies.

- The interest rate ceiling at which the “buy now, pay later” business model is put to the test

- The impact of changing interest rates on customer retention and financial risk

- Possible alternatives and adjustments to the business model as interest rates rise

Companies offering this business model should prepare for rising interest rates and adjust their business strategy accordingly. This could include introducing new payment methods or increasing the interest rate. A comprehensive analysis of the impact of rising interest rates on the business model is critical to ensure long-term success.

Alternatives to the current model: the end of buy now, pay later?

Rising interest rates are putting the “buy now, pay later” business model to the test. More and more customers are wondering if this payment option is still viable or if there are alternatives. Companies therefore need to consider how they can adapt to this challenge.

One option is flexible installment payments, where the customer can determine the amount of the installments and thus also the term itself. Another approach is credit cards offered in conjunction with a rewards program. Here, the customer can collect points that can later be exchanged for rewards or discounts.

Another important consideration is transparency around interest rates and fees. Companies should openly communicate what costs the customer will incur and how these will be reflected in the installments. The customer's creditworthiness should also be presented transparently to avoid unpleasant surprises.

- Offer flexible installment plans.

- Use credit cards with bonus programs.

- Ensure transparency on interest rates and fees.

- Be transparent about the customer's credit score.

Through these measures, companies can strengthen the trust of their customers and set themselves apart from the competition. It is important to remain flexible in times of rising interest rates and to offer alternatives to ensure long-term success.

Conclusion

After analyzing the “buy now, pay later” trend business model, it is clear that rising interest rates may pose a challenge to this model. Customers using such offers may experience a higher financial burden if interest rates rise.

However, demand for “buy now, pay later” offers may remain high, as this type of credit is an attractive option for many consumers. Financial firms may need to adjust their offerings to accommodate rising interest rates and meet consumer needs.

Another issue to consider is the increasing regulation of financial products. If legislation changes, this could impact the business practices of companies offering “buy now, pay later” offers. Companies should therefore carefully consider how they want to set up their business models and what risks they are willing to take.

- Overall, it can be said that the “buy now, pay later” business model is put to the test when interest rates rise.

- Companies may need to adjust their offerings and business practices to accommodate rising interest rates and increasing regulations.

- Nevertheless, demand for such offers may remain high, as they represent an attractive option for consumers.