Are you having trouble making your mortgage payments? If you took out a mortgage with a bad credit score, it can be difficult to pay off your debt. Fortunately, there are some things you can do to improve your situation. One option is to restructure your mortgage. Here are five tips that can help you restructure your mortgage with a bad credit score.

Evaluate your credit score. Before you embark on debt restructuring, it’s important to understand your credit score. Review your credit reports from the three main bureaus and make sure any errors are fixed. Before signing up for a debt restructuring program, make sure your credit score has improved.

Review your finances. Before you sign up for a debt restructuring, make sure you are financially stable. Review your monthly income and expenses to make sure you can afford the interest and principal payments. Rescheduling can help you lower those rates, but it’s still important to stay on top of your budget.

Look for options. There are many different debt restructuring options to refinance your mortgage. Contact your mortgage servicer and make sure you know all the options available to you. There are many debt restructuring programs designed specifically for people with bad credit scores.

Focus on the numbers. When you sign up for a debt restructuring program, it’s important to pay attention to the numbers. Most programs have interest and principal rates that are lower than your current mortgage. Make sure you understand how these rates will affect your monthly payments.

Work with your intermediary. If you are refinancing a mortgage, it is important to work with your intermediary. Your credit score won’t improve overnight, and it may take time and patience to make your consolidation a success. Make sure you speak with your intermediary regularly to ensure you’re on the right track.

How to check your credit score

1. Review your credit reports regularly. It is important to regularly check your credit reports from the three major credit reporting agencies. If you have a poor credit score, make sure all information is accurate and that no incorrect information has been reported. If an incorrect piece of information is found, you should report it to the credit reporting agency.

2. Check your credit scores. In addition to checking your credit reports, you should also check your credit scores. Your credit scores will give you an idea of what interest rate you will receive and how much your monthly payments will be.

3. Pay your bills on time. One of the most important ways to improve your credit score is to pay your bills on time. Paying late can negatively impact your credit scores and make it harder to refinance a loan.

4. Reduce your debt. A high debt-to-income ratio can hurt your credit score. It’s important to reduce your credit card balances and pay off your debt as quickly as possible.

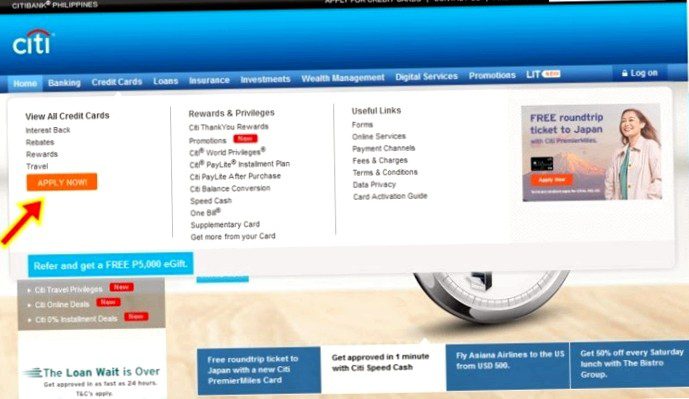

5. Look for appropriate refinancing options. Even with a poor credit score, you may be able to find a refinancing option that works for you. It’s important to compare different lenders and look for options that are right for your financial situation.